For many hurricane victims, the recovery period has damaged more than physical property. Homeowners have depleted funds or taken on credit card debt to replace damaged personal items and rent undamaged property to stay sheltered during this recovery period. Those looking for assistance to help their rebuilding process might run into issues borrowing due to a lack of down payment or credit score issues.

Fortunately, qualified victims can receive 100% financing, with no down payment through the FHA 203(h) loan. According to the U.S. Department of Housing and Urban Development, “Through Section 203(h), the Federal Government helps victims in Presidentially designated disaster areas recover by making it easier for them to get mortgages and become homeowners or re-establish themselves as homeowners.”

The Details

To qualify, you must live in a presidentially declared disaster area (see FEMA map)2 and make a claim within 1 year of that declaration, or by August 24, 2018 for Hurricane Harvey. Keep in mind, this program is for primary residential homes only. Unfortunately, vacation homes, time shares, and other non-primary residences are not eligible.

Make a claim by August 24, 2018.

Relaxed Credit Requirements

The FHA 203(h) loan is more lenient on credit scores than the standard FHA loan. A score of 500 will likely qualify most applicants. Applicants with a low credit score because of an inability to make payments due to the declared disaster may even be considered a satisfactory credit risk, allowing borrowers to provide lower interest rates on a mortgage loan despite a low credit score.

Rebuild or Relocate

The FHA 203(h) allows borrowers to purchase or reconstruct a single-family property with their mortgage loan. Even effected borrowers who choose to rebuild outside of the declared disaster can take advantage of the FHA 203(h).

You’re not required to rebuild within the disaster area.

FHA Rules Apply

At the end of the day, FHA 230(h) mortgage loans are still an FHA product, and typical FHA guidelines still apply.

- Applicants will have limits to the amount they can borrow,

- Each home will have a strict set of appraisal standards

- Applicants will need to pay for Mortgage Insurance.

An upfront and ongoing premium will be necessary. Most borrowers roll the upfront cost into their loan amount.

If you’re contemplating whether the FHA 203(h) mortgage option is right for you, we’re here to help. Rock Mortgage’sregistered RMLO home loan experts advise home buyers on which mortgage options are best suited for their individual needs. Call Rock Mortgage today at 832-230-3067 or begin the process directly on our site. We’ll be in touch soon and look forward to working with you!

Resources

- “Hurricane Harvey wreaks historic devastation: By the numbers” – ABC News – 9/1/17

- “Texas Hurricane Harvey” Disaster Declaration Map – FEMA – 8/25/17

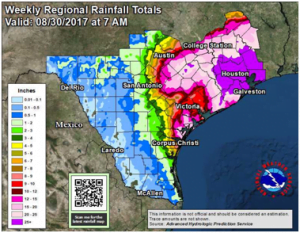

- Picture “Weekly Regional Rainfall ending August 30th, 2017” – NWS – 8/30/17

- “Mortgage Insurance for Disaster Victims Section 203(h)” – HUD