Our Loan Products

Choose the one that best suits your financial situation

Buying a home is exciting, but figuring out the financing side of things can feel overwhelming. Chin up: Choosing a mortgage isn’t all that painful if you know the lingo. Once you’ve done some homework and nailed down a budget and down payment amount, and you’ve reviewed your credit, you’ll have a better idea of what loan works best for your needs.

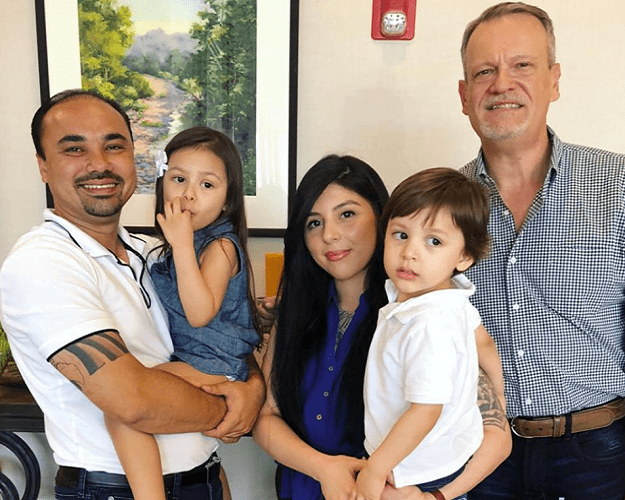

First Time Home Buyers in Houston May Not Need a Significant Down Payment

A down payment of 20%, or one-fifth of the total purchase price, is often recommended as appropriate for first-time home buyers. Even with Houston home prices being below the national average, this can be an unattainable goal. The good news is, in most cases, a 20% down payment is not necessary to secure a mortgage. Depending on the loan you choose, you may only need to make a down payment of up to 3.5%. With some mortgage products, there is no down payment required at all.

While this makes mortgages much more attainable for people of modest means, there is a tradeoff involved. First-time home buyers Houston who make a low down payment typically have to pay mortgage insurance as part of their monthly mortgage payment. This is separate from the homeowner's

policy that you have to obtain to secure your mortgage, protecting you from damage to your property. You must factor both the mortgage insurance and the homeowner's insurance premium into your monthly mortgage payment when determining whether you can afford it.

FHA LOAN

If you’re a first time home buyer or have a lower than average credit score, an FHA loan may be a great option for you. These loans have lower down payments, but additional stipulations, so it’s important to know what makes FHA loans different from traditional loans.

Homebuyers often review several mortgage company Houston options before making a choice. In the end, most realize that FHA loans are much easier to qualify for than many other mortgage loan programs. One reason for this is that the federal government backs the loan, thereby providing banks with some insurance should you default.

These are some key reasons to consider this loan type:

Low down payments

Lower required credit score to qualify

Great option for first time home buyers

Lower income requirements to qualify

JUMBO LOAN

Whether you have a large family or your dream home is in a more expensive area in Texas, you will likely need to borrow a sizable amount of money. Conventional lenders are subject to limitations on the amount of money they can lend, which is why Jumbo Loans were created.

In most Texas communities, you may run into a conventional loan limit of little more than half a million dollars. For some families, this is more than enough. However, families that belong to the upper-middle and upper classes may need much bigger mortgages to purchase homes that meet their needs.

Even so, these are some important factors to note before choosing this loan:

Useful for loans above the conventional lending limit

Stringent debt-to-income ratio requirements

High credit score required to qualify

May be used to purchase a vacation home

VA LOAN

VA loans were created for veterans, service members, and sometimes military spouses. However, it can be difficult sometimes to know if you qualify and what different options you have in a VA loan compared to a traditional loan.

The good news is that finding out whether you qualify and proving your eligibility is fairly easy at our mortgage company Houston.

Former and current military personnel may begin by speaking to Veterans Affairs. Rock Mortgage will request a Certificate of Eligibility as proof of service. Veterans can provide discharge documents to show the discharge was not dishonorable. Spouses need to provide proof of marriage and may need to fill out forms to determine eligibility:

Below are some of the many reasons current and former military personnel prefer VA loans:

Available to veterans and service members

Low down payments

Need to get a COE to qualify

Suitable even for average credit scores

TEXAS CASH OUT LOAN

Texas Cash Out Loans are often described as a cross between an equity loan and a traditional refinanced mortgage. When homeowners refinance their mortgage, they get cash for a percentage of the difference between the remaining value of the loan and the current value of the home.

There are many reasons you may wish to withdraw some of the equity from your home. You may want the cash to make improvements, such as building a tiny house for personal use or renting. Other potential uses for the money withdrawn include paying off high-interest debt, starting a business, buying a second property, or paying for college.

Before choosing a Texas cash out loan, make a note of the following key features:

Can only withdraw equity once per year

Must leave at least 20% of your house’s equity

Credit score and debt-to-income ratio will affect approval

Can lower your monthly mortgage payment

How To Choose the Right Loan

Knowing the benefits of available loans at our mortgage company Houston is a good first step, but you also need to analyze your personal needs. Several components of your specific circumstances may help you better decide what loan option may work best for you.

Using your particular needs as a starting point in your homebuying journey can help you keep your emotions in check. Doing so can help you create a foundation for financial stability in the years to come. With this goal in mind, here are some questions you may need to ask yourself:

- How high is my credit score, and do I have time to improve it?

- How much money do I have to offer the bank as a down payment?

- How does the cost of the home I wish to buy compare to those around it?

- Will the lender class me with first time home buyers, veterans, or anything else that may give me more favorable terms?

- Will I use this property as my primary residence, an investment property, or a vacation home?

- What are my options for financing versus refinancing my home?